You walk into a store for one thing. Toothpaste. Maybe some milk. Thirty minutes later you’re at the register with $87 worth of stuff you didn’t plan to buy.

Sound familiar? It should. Because it’s not an accident.

Every detail in that store was designed to do exactly this. The layout. The lighting. The music. The way the products are arranged. Even the smell. Retail researcher Paco Underhill spent decades tracking shoppers with cameras and clipboards. What he found is unsettling. Stores perform a kind of “retailing judo.” They use your own momentum, your unspoken desires, to steer you in directions you never planned to go.

And the tricks go way deeper than clever shelf placement.

Your Brain Doesn’t Shop the Way You Think It Does

Here’s the uncomfortable truth. You think you’re a rational shopper. You compare prices. You read labels. You make logical choices. But behavioral economists have proven over and over that this isn’t how your brain actually works.

Daniel Kahneman won the Nobel Prize in Economics for showing that our decisions are based on psychological shortcuts, not careful logic. He’s not even an economist. He’s a psychologist. That should tell you something about how “rational” our buying decisions really are.

Reference Points Run the Show

One of the biggest discoveries in behavioral economics is called prospect theory. The core idea is simple. You don’t judge prices in absolute terms. You judge them relative to a reference point.

Here’s what that looks like in practice:

- A $5 coffee seems cheap in New York City. The same coffee seems outrageous in rural India.

- Your grandparents think $11 for a movie ticket is a ripoff. They remember when tickets cost 40 cents.

- A $250 grill feels like a steal when it’s marked down from $350. But a $240 grill marked down from $255 feels like a bad deal. Even though it’s literally cheaper.

Jonah Berger ran a study where 75% of people said they’d buy a grill marked down from $350 to $250. But only 22% would buy the same grill priced at $240 (down from $255). People actually paid MORE money because the discount looked bigger. The final price was higher and they were happier about it.

Your brain doesn’t care about the actual price. It cares about the story the price tells. These same principles power the hidden rules of persuasion that shape decisions far beyond the checkout aisle.

“People don’t evaluate things in absolute terms. They evaluate them relative to a comparison standard, or reference point.” - Daniel Kahneman

The Pricing Tricks That Get You Every Time

Stores have turned reference points into an art form. Here are the most common tactics they use to make you think you’re getting a deal.

The Anchor Drop

Anchoring is when a store plants a high number in your head before showing you the real price. Dan Ariely’s research shows that the first price you see sticks in your brain like glue. Everything after that gets compared to it.

Think about infomercials. “You might expect to pay $100 or even $200 for these knives. But today, just $39.99!” That $200 number is pure fiction. But it works. Your brain grabs onto it and suddenly $39.99 feels like you’re stealing.

Ariely proved that anchoring effects last way beyond the initial moment. Once a price gets locked into your head, it shapes your decisions for weeks. People who saw a high anchor kept paying high prices. People who saw a low anchor kept demanding low prices. Your first impression literally programs your future spending.

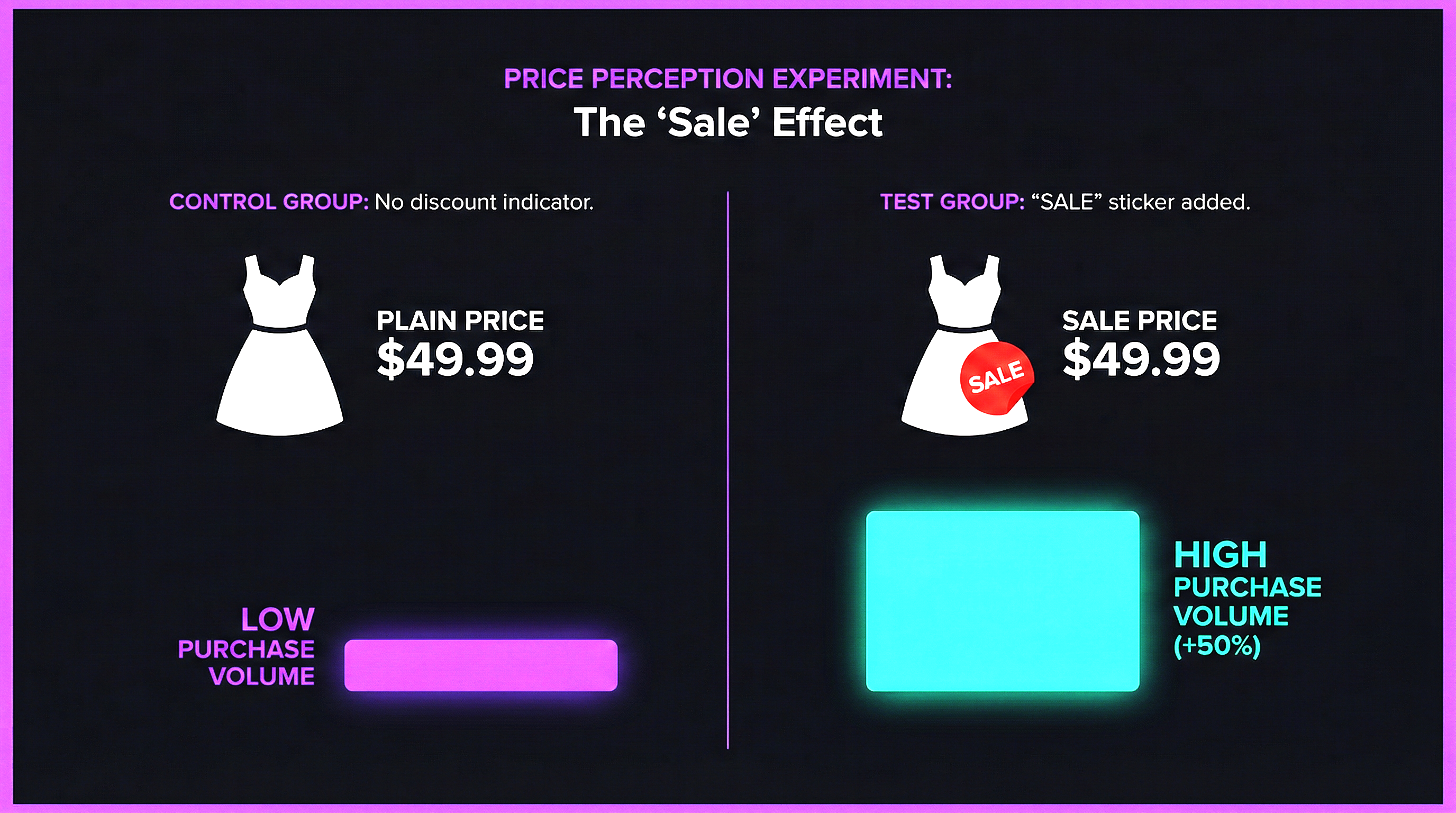

The “Sale” That Isn’t

Marketing researchers Eric Anderson and Duncan Simester tested something wild. They sent out two versions of a clothing catalog to over 50,000 people each. In one version, certain dresses were marked “Pre-Season SALE.” In the other version, the exact same dresses appeared at the exact same price. No sale tag.

The result? Just adding the word “sale” increased purchases by more than 50%. The price didn’t change at all. The word alone did the work.

The Pile-It-Up Trick

At Victoria’s Secret, underwear often gets piled on a table marked “4 pair for $20.” That sounds like a steal. But they normally charge $5 a pair. It’s the same price. The bundle framing just makes it feel like a bargain.

| Pricing Trick | How It Works | Why Your Brain Falls For It |

|---|---|---|

| Anchor drop | Show a high “original” price first | First number becomes your reference point |

| Fake sale tag | Label something “on sale” at the same price | The word “sale” triggers deal-seeking instincts |

| Bundle framing | ”4 for $20” instead of “$5 each” | Bundles feel like you’re getting more |

| Diminishing sensitivity | $10 off a $35 item feels big. $10 off a $650 item feels pointless | Same savings, but your brain treats it as a percentage |

| Clearance placement | Discount rack near the front door | Bargain hunters never make it to full-price sections |

Recommended read: Predictably Irrational by Dan Ariely. A fascinating look at why we consistently make irrational decisions and how businesses exploit those patterns.

The Store Is a Trap for Your Senses

Pricing tricks are just the start. The physical store itself is designed to keep you inside longer. And the longer you stay, the more you buy. Paco Underhill’s research proved this conclusively. Time in store equals money spent. Period.

Touch Is the Secret Weapon

Here’s a stat that should change how you shop. Almost all unplanned purchases happen because someone touched, smelled, tasted, or heard something in the store. Underhill calls this the “sensory” nature of shopping. We don’t buy with our heads. We buy with our hands.

- Towels get touched by an average of six different shoppers before someone buys them

- Stores that let you handle products sell dramatically more than stores that lock things behind glass

- Car dealerships insist on test drives because once you’re behind the wheel, you already feel like it’s yours

- Free samples at the grocery store aren’t generosity. They’re a calculated trigger

This connects to something psychologists call the endowment effect. Once you touch something, once you hold it, your brain starts treating it as yours. And you value things you “own” more than things you don’t.

David McRaney describes a classic experiment. Researchers asked people how much a water bottle was worth. Everyone agreed on about $5. Then they gave the bottle to one person for free. An hour later, that person wouldn’t sell it back for less than $8. Ownership. Just holding it. That’s all it took to change the price in their mind.

The Layout Is the Trap

Stores don’t just put products on shelves randomly. Every aisle, display, and sign is engineered to guide your path.

- The bakery smell leads you to the bakery aisle. You didn’t plan to buy bread. Now you want bread.

- Mirrors slow shoppers down. People stop and preen, and whatever merchandise is nearby gets more attention.

- Discovery paths make you feel like you’re finding things on your own. Stores create subtle “scent trails” through suggestions and hints so you feel like a hunter tracking prey. Not a target being guided.

- Discount tables near the front create a “shallow loop.” Shoppers grab the bargain and never explore the rest of the store. One bookstore found their bargain table was destroying sales of full-price books.

Underhill’s team discovered something retailers themselves didn’t know. When they asked a senior executive at a multibillion-dollar chain how many people who enter the store actually buy something, he was “very wrong.” Most retailers have no idea how their store actually functions as a psychological environment.

Recommended read: Why We Buy by Paco Underhill. The definitive guide to how stores are designed to separate you from your money, written by the man who invented the science of shopping.

Your Spending Data Is a Personality Test

The manipulation doesn’t stop at the store exit. In the digital age, what you buy reveals who you are. And companies are using that information to target you with scary precision, often through dark patterns designed to trick your brain into handing over even more data.

Sandra Matz and her colleagues at Columbia Business School studied the bank transactions of over 2,000 people. They matched spending patterns to personality traits. The results were remarkably accurate.

Here’s what your spending says about you:

| Personality Trait | High Spender In… | Low Spender In… |

|---|---|---|

| Extroversion | Dining, drinking, clothes, taxis | Medication, home electronics, pets |

| Conscientiousness | Savings, holiday funds, beauty | Snacks, takeout, mobile phone |

| Openness | Art, books, experiences | Routine purchases |

Your credit card swipes create a unique psychological fingerprint. Combine what you buy, where you buy it, and when. That fingerprint is probably unique to you on the entire planet. And companies like Hilton Hotels are already using it.

Matz helped Hilton build an application that generated vacation recommendations based on your personality. Introverted? Quiet beach resort. Neurotic? All-inclusive with nothing left to chance. Over 60,000 people used it in three months. They clicked, shared, and purchased.

A beauty retailer took it further. They designed different ads for different personalities. Extroverts saw a woman at the center of a dance floor surrounded by friends. Introverts saw a woman enjoying products from the comfort of her cozy home. Same products. Different psychological wrapper. Sales went up.

Recommended read: Mindmasters by Sandra Matz. A Columbia professor reveals how your digital footprint exposes your personality and how companies use it to change your behavior.

Why You Defend the Brands That Manipulate You

Here’s the strangest part. Even when you know you’re being played, you’ll defend the brands that do it.

David McRaney explains this through three overlapping biases:

- The endowment effect. You value what you own more than what you don’t. Your iPhone isn’t just a phone. It’s YOUR phone. And therefore it’s better than other phones.

- The sunk cost fallacy. You’ve invested so much money in a brand that switching feels like admitting you wasted all that money. So you stay.

- Choice-supportive bias. This is the big one. After you pick something, your brain rewrites history to make it seem like the best possible choice. You forget the downsides and exaggerate the benefits.

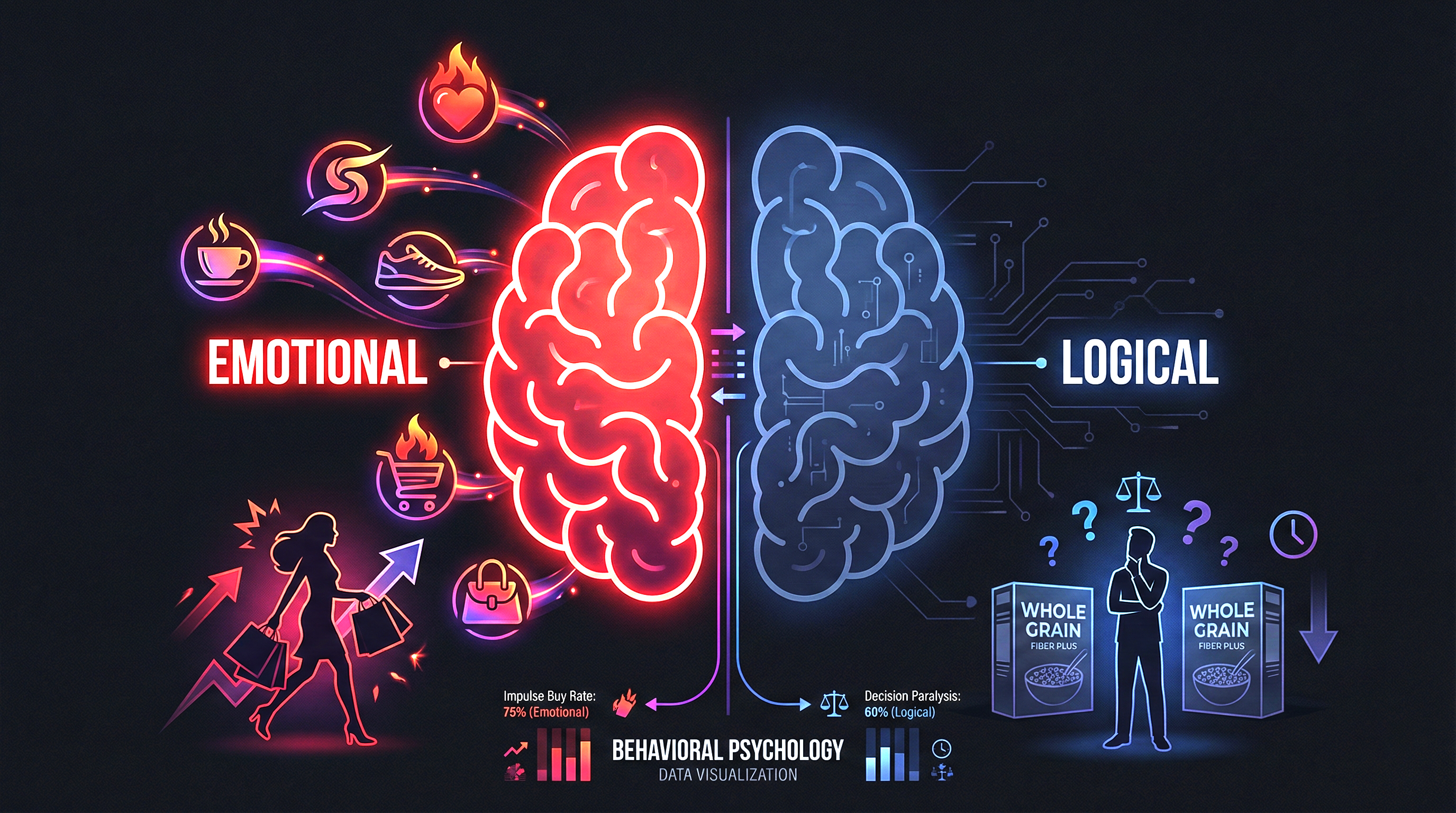

These are just a few of the cognitive biases quietly sabotaging your everyday decisions. They feed what McRaney calls “fanboyism.” Apple users don’t just prefer Apple. They believe Apple is objectively superior. But the research shows something fascinating. People with brain damage to their emotional centers, who can only think logically, literally cannot decide between two brands of cereal. They stand frozen in the aisle, weighing every variable. It turns out that choosing a brand is purely emotional. Logic has almost nothing to do with it.

Retailers know this. That’s why smart stores limit your options at the point of purchase. Fewer choices mean less post-purchase regret. And less regret means more repeat customers.

Recommended read: You Are Not So Smart by David McRaney. A witty tour of 48 cognitive biases that shape every decision you make, including why brand loyalty is mostly self-delusion.

How to Shop Smarter Starting Today

You can’t eliminate these biases. They’re baked into your brain. But you can make them work a lot less effectively.

-

Ignore the “original” price. That crossed-out number exists only to anchor your brain. Ask yourself: “Would I pay this sale price if there were no discount?” If no, walk away.

-

Stop touching things you don’t intend to buy. Seriously. The endowment effect activates the moment something is in your hands. If you’re browsing, keep your hands in your pockets.

-

Shop with a list and a timer. The longer you’re in a store, the more you spend. Set a time limit. Stick to your list. Treat extra items as a game the store is trying to win.

-

Wait 24 hours on anything over $50. Most impulse purchases lose their appeal overnight. The dopamine fades. The “reference point” resets. Tomorrow you’ll wonder what you were thinking.

-

Watch for the word “sale.” Remember, labeling something “on sale” increases purchases by 50% even when the price hasn’t changed. The word itself is a psychological trigger. Don’t let a four-letter word override your judgment.

The Bottom Line

Every store you walk into is a carefully engineered psychological environment. The prices, the layout, the lighting, the smells. None of it is random. It’s all designed to exploit the shortcuts your brain takes when making decisions.

But here’s the thing. These tricks only work when you don’t know about them. Now you do. The next time a “deal” seems too good to pass up, pause. Ask yourself who set that reference point. Ask yourself why you’re holding that product. Ask yourself if you walked in planning to buy it.

The most powerful thing you can do as a shopper is slow down. Because speed is what they’re counting on.